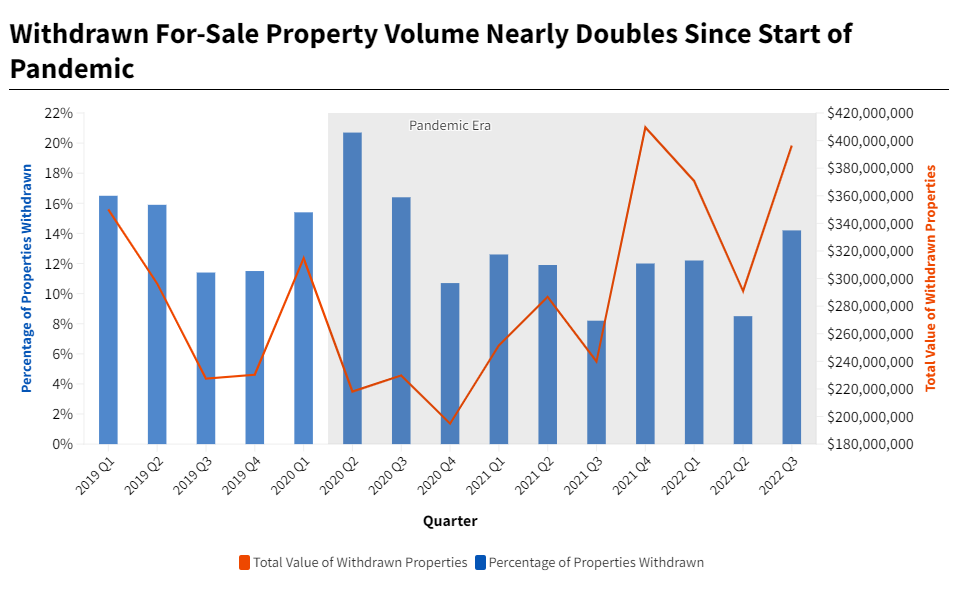

More Commercial Property Sellers Are Giving Up

Listings Taken Off Market Surge to Two-Year High, CoStar Data Shows

Commercial property sellers are reassessing the market, taking more listings down in a change from mostly receiving their asking prices over the past year as property sold in a near-low number of days.

The percentage of for-sale properties being pulled off the market by sellers surged in the third quarter to 14.2%, the highest in two years, from 8.2% in the year-earlier quarter. The value of withdrawn properties rose to $396.4 million from $239.9 million in the year-earlier quarter.

The gap between asking price and sale price has started to widen as steeper borrowing costs have set in and fewer deals are getting done, according to the most recent CoStar data. The sale-price-to-asking-price ratio retreated 0.3 percentage points to 94.4% in October but remains near the historical high reached in May.

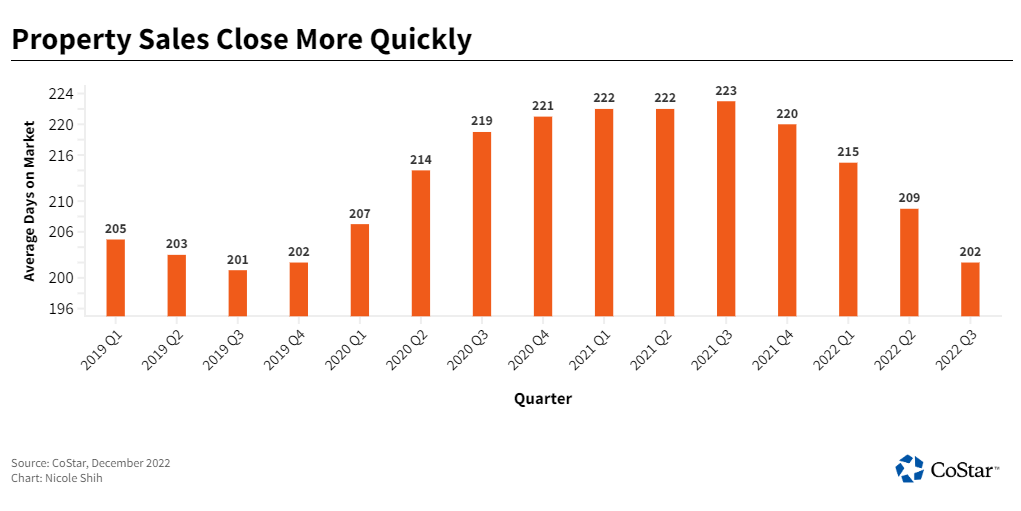

It’s not all gloom for sellers, though. The average number of days on the market for for-sale properties fell for its fourth consecutive quarter to 202 days, CoStar data shows. That is the shortest amount of time since the end of 2019 and is generally an indicator that sellers were achieving their expected results.